Table of Content

It offers a straightforward user interface that makes it easy to do your taxes accurately the first time. You have to file a business tax return for the LLC by March 15 with TurboTax Business not to be confused with Home and Business. Your income from the LLC will be reported on your personal tax return, which can be filed using any of our versions for your personal taxes depending on your tax situation. If you already have a 1099-Misc or W-2 from your LLC you can file your taxes now. You will need to do the Form 1065 before your personal return because you will need the K-1s.

These amounts are what each owner will report on his or her personal 1040 tax return and what the IRS will be looking for from each owner. The Self-Employed edition includes access to a tax professional for help with all of your individual tax questions while completing your taxes. It also includes phone, live chat, and email support as well as technical support. Both the Premium and Self-Employed editions include Audit Assistance for up to 3 years after your return is accepted. If you run a small business, preparing accurate annual tax returns is required by law. According to the National Society of Accountants, the average cost to prepare taxes for a small business ranges from around $184 per year for a Schedule C to around $826 per year for a corporation.

Help and Support

Our Full Service Guarantee means your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they know it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. FreeTaxUSA includes a maximum refund guarantee and 100% accuracy guarantee.

For example, you may want to be able to issue stock, so you can reward key employees by giving them stock options. Also, in some states certain types of businesses, including banks and insurance companies, can't form LLCs. You want a program that can help find all the possible deductions you qualify for to make sure you get the most out of your return. We recommend the best products through an independent review process, and advertisers do not influence our picks.

Expert does your taxes

The purpose of reporting half the income or loss for each spouse is to properly allocate self-employment income, and self-employment tax, to each spouse which generates credits in the Social Security system. If you want extra help and have questions about your taxes along the way, TurboTax Live is an add-on that includes access to a CPA or other tax expert on-demand, including evening and weekend hours. The TurboTax Live Self-Employed edition costs $199 plus $54 per state.

The 2 Schedule Cs route will require only one program whereas the LLC 1065 route requires both programs be purchased. Most tax software packages come with similar guarantees for accuracy and a maximum refund, but the user experience and features can vary widely. To select the best tax software for small business, we reviewed 10 different software options based on product features, ease of use, accuracy, and more. So, if you’re looking to do taxes for a small business this year, here are the best tax software offerings for you. Businesses that meet the definition of qualified joint venture may elect to file two Schedules C, Schedules E, or Schedules F, with the couple's joint tax return, instead of filing a partnership tax return. Each Schedule C or F should report one half of the business income and expenses for each spouse.

What Tax Forms Do I Need to File My Tax Return?

When filing taxes for your limited liability company, the most important step is understanding how the IRS treats LLCs in regard to taxation. I am new in Network Marketing and need to know what forms to file and also do I file this this separately from my personal taxes or do I just include it in with my personal taxes and add the extra forms? Partnership returns and Form 1040 Schedule C must be filed by the April tax deadline.

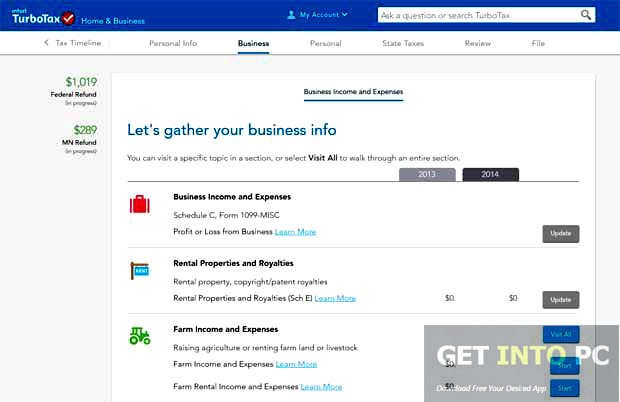

If you choose the free edition, you have access to every federal tax form and won’t have to pay anything in most cases. If you are looking for a budget-friendly solution for your self-employed tax return, FreeTaxUSA may be your best choice. Most business owners using the online version of TurboTax would benefit from TurboTax Self-Employed, which includes personal and business income and expense tax forms. Windows users can install TurboTax Home & Business, which includes 5 federal e-files and 1 state for $200. This version is needed if you want to prepare taxes for a partnership or corporation.

This version includes tax preparation for a 1040 Schedule C for those who operate as sole proprietors as well as LLCs. If you have a side hustle and get a 1099 tax form, for example, TaxSlayer Self-Employed would handle your needs. Active-duty military can file all federal tax forms for free and just pay $39.95 per state. If you have more than one member in your LLC, the IRS will consider your company to be a partnership for tax purposes. Therefore, the LLC will not have to pay taxes directly from the business.

Tax software for small business is an online, desktop, or mobile option to complete your taxes on your own without paying a professional preparer. Depending on the software you choose, you may be able to file self-employed taxes with a Schedule C or more complex taxes for a partnership or corporation. While personal tax preparation software focuses only on Form 1040 in most cases, small business tax software has the ability to complete taxes for businesses of all sorts. Whether you file online or with the download version, the tax software comes with a maximum refund guarantee and 100% accuracy guarantee. Whichever you choose, H&R Block covers most tax situations and is a top choice for many business owners, which is why it gets our best overall ranking.

They usually have a preprinted form where you just fill in the blanks to provide your company's information, or they have a sample form to follow. An LLC can help reduce your liability without reducing your freedom to run your business as you see fit. And we have you covered at tax time, with TurboTax Home & Business for single-member LLCs, and TurboTax Business for multiple-member LLCs. Turbo Tax Business is not available to do online or on a Mac.

The software program does a good job of walking you through complex tax situations. If you think you’ll need extra help, you can upgrade to Online Assist, which allows you to do your taxes on any device with unlimited, on-demand help from a tax pro. It costs $159.99 for Premium or $194.99 for Self-Employed, plus $49.99 per state. I formed an LLC late last year, but have not actually starting operating yet. I am a single member LLC, so I know I would include any information in my personal taxes. It’s important to keep accurate records of your business income and expenses, as you will be required to report them on your taxes.

UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. You want the program to be easy to use, even for someone not certified in the tax code. I have a single member LLC, a multi-member LLC, and one schedule C form. Reconcile financial statement net income for the partnership to line 1 of the Analysis of Net Income found on Form 1065 and Form 1065-B. Answer questions about their financial statements and reconcile financial statement net income for the consolidated financial statement group to income per the income statement for the partnership.

What I really need is to be able to talk with a live person to walk me through the process. The Instructions for Form 1065 have the submission information for you to send in your return.

More Products from Intuit

Corporate tax returns are due a month earlier, by the March 15th deadline. If you have a simple tax return, you can file with TurboTax Free Edition, TurboTax Live Assisted Basic, or TurboTax Live Full Service Basic. If you did not file your final partnership return you can do that by hand using the IRS forms or you can use TurboTax Business software.

H&R Block is a well-known brand in personal and business tax preparation. It was founded in 1955 and has prepared more than 800 million tax returns. If you want to do your own taxes, you can choose between online and downloadable versions of H&R Block’s tax software.

No comments:

Post a Comment